The Best Guide To Broker Mortgage Fees

Wiki Article

Getting My Broker Mortgage Near Me To Work

Table of ContentsThe Buzz on Mortgage Broker Vs Loan OfficerThe Best Strategy To Use For Mortgage Broker AssociationNot known Factual Statements About Mortgage Broker Job Description The Ultimate Guide To Broker Mortgage FeesFacts About Mortgage Broker Meaning UncoveredThe Only Guide to Mortgage Broker Job DescriptionHow Mortgage Broker can Save You Time, Stress, and Money.Some Ideas on Broker Mortgage Fees You Should Know

What Is a Mortgage Broker? A home loan broker is an intermediary between a financial organization that uses car loans that are protected with actual estate as well as individuals thinking about acquiring property that require to borrow cash in the form of a funding to do so. The home loan broker will certainly deal with both celebrations to get the individual approved for the lending.A home loan broker generally works with many various lending institutions as well as can use a variety of financing choices to the debtor they function with. The broker will certainly gather info from the individual as well as go to several loan providers in order to locate the finest potential funding for their customer.

Mortgage Broker Vs Loan Officer Fundamentals Explained

All-time Low Line: Do I Required A Home Loan Broker? Collaborating with a home mortgage broker can save the consumer effort and time throughout the application procedure, and potentially a great deal of money over the life of the lending. In enhancement, some lenders work solely with home loan brokers, indicating that consumers would certainly have access to financings that would certainly or else not be offered to them.It's vital to analyze all the fees, both those you might have to pay the broker, as well as any charges the broker can aid you stay clear of, when evaluating the choice to function with a home mortgage broker.

Things about Mortgage Broker

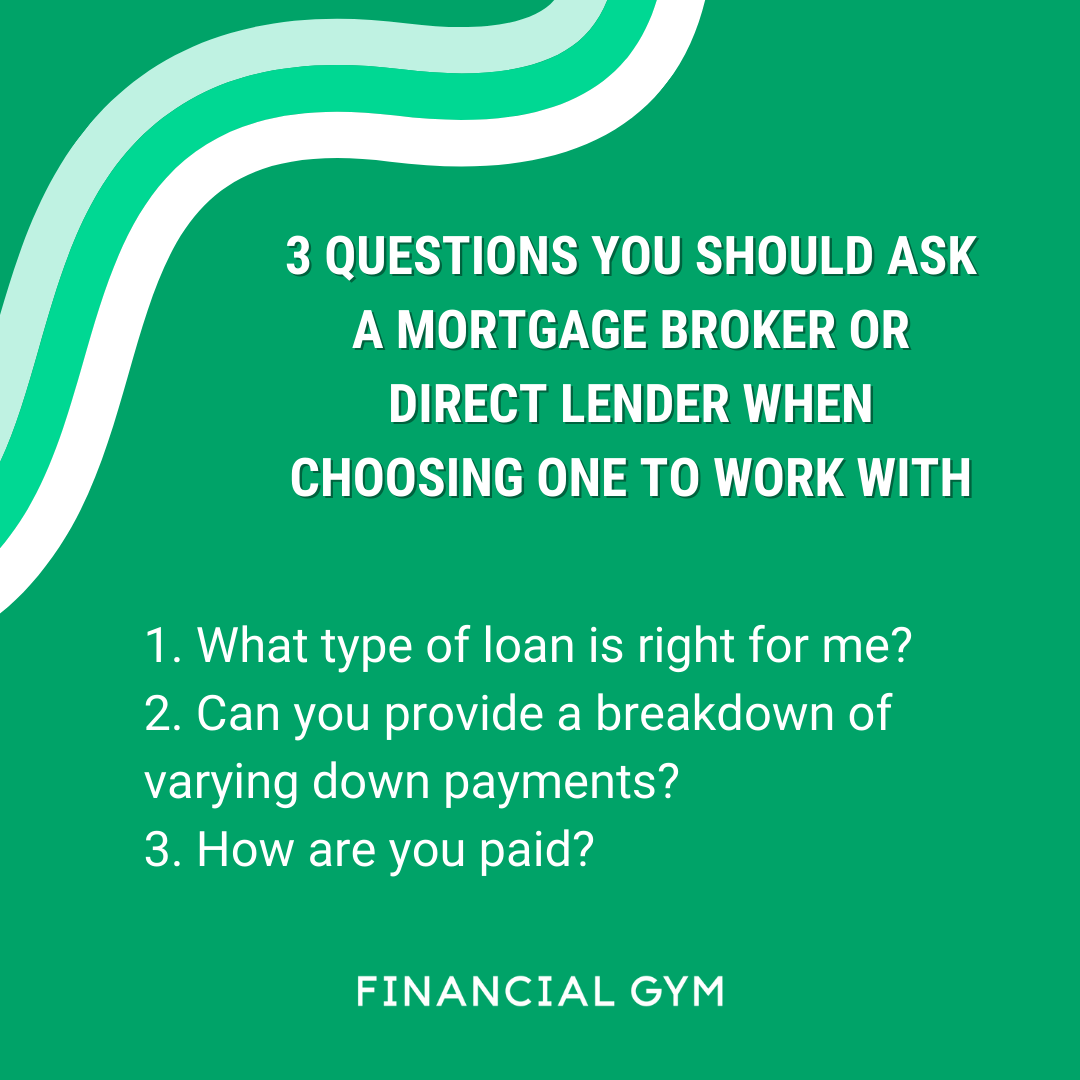

You have actually probably listened to the term "home mortgage broker" from your genuine estate representative or pals who have actually acquired a house. But just what is a home mortgage broker as well as what does one do that's various from, state, a funding police officer at a financial institution? Geek, Budget Guide to COVID-19Get solution to inquiries concerning your home loan, traveling, finances and also preserving your tranquility of mind.1. What is a mortgage broker? A home loan broker functions as a middleman in between you as well as possible lending institutions. The broker's work is to compare home mortgage loan providers on your behalf and find rates of interest that fit your demands - broker mortgage near me. Home loan brokers have stables of loan providers they collaborate with, which can make your life simpler.

Mortgage Broker Average Salary Fundamentals Explained

How does a mortgage broker obtain paid? Home mortgage brokers are most frequently paid by lending institutions, often by customers, however, by regulation, never both.The competition and home costs in your market will have a hand in dictating what home mortgage brokers charge. Federal legislation restricts just how high compensation can go. 3. What makes home mortgage brokers various from funding policemans? Funding policemans are employees of one lending institution that are paid established salaries (plus incentives). Financing policemans can create just the types of loans their company selects to offer.

The smart Trick of Broker Mortgage Calculator That Nobody is Talking About

Home mortgage brokers may be able to offer customers access to a broad choice of lending types. You can save time by using a mortgage broker; it can take hrs to use for preapproval with different loan providers, then there's the back-and-forth communication entailed in financing the financing and making certain the deal stays on track.When choosing any lending institution whether with a broker or directly you'll want to pay attention to lending institution costs." Then, take the Car loan Estimate you get from each lender, put them side by side and also contrast your interest price as well as all of the fees as well as closing expenses.

The Buzz on Broker Mortgage Meaning

Just mortgage broker reviews how do I choose a home mortgage broker? The best means is to ask buddies as well as loved ones for referrals, yet make sure they have in fact click resources used the broker and aren't just dropping the name of a previous university flatmate or a distant acquaintance.

Getting The Mortgage Broker Salary To Work

Competitors as well as house rates will certainly influence how much home loan brokers obtain paid. What's find out here the difference in between a home loan broker and a loan police officer? Funding police officers function for one loan provider.

Mortgage Broker Salary for Beginners

Purchasing a brand-new residence is among one of the most complex events in a person's life. Characteristic differ significantly in terms of design, services, institution area as well as, naturally, the constantly important "place, location, location." The mortgage application procedure is a complex facet of the homebuying procedure, specifically for those without previous experience.

Can figure out which issues may develop troubles with one loan provider versus an additional. Why some customers prevent home mortgage brokers Sometimes buyers feel extra comfortable going straight to a big bank to protect their car loan. Because situation, purchasers need to a minimum of talk to a broker in order to understand every one of their alternatives relating to the kind of loan and the readily available rate.

Report this wiki page